Case Study: Salesforce Data Cloud Integration for Financial Decision-Making

Background Story:

A prominent financial services firm, FinTrust Inc., had built a strong customer base over the years but faced mounting challenges in maintaining customer loyalty and scaling its marketing efforts. With data scattered across legacy systems, the firm struggled to gain actionable insights into its customer behaviors, preferences, and lifetime value. Marketing campaigns often missed the mark, resulting in disengaged customers and underwhelming returns on investment.

The leadership team realized that embracing a data-driven marketing approach was essential to stay competitive in a rapidly evolving financial landscape. After evaluating various solutions, they chose Salesforce Data Cloud and Marketing Cloud to revolutionize their data management and marketing strategies.

Problem Statement

The Challenge

- Data Silos Across Systems:

- Customer and transactional data spread across multiple legacy platforms, making it difficult to create a single source of truth.

- Ineffective customer segmentation due to disconnected data sources.

- Lack of Actionable Insights:

- The firm struggled to predict customer churn or identify high-value clients.

- Marketing efforts were often generic, leading to low engagement.

- Inconsistent Campaign Effectiveness:

- Marketing campaigns lacked personalization, making them less relevant to customers.

- Budget inefficiencies due to trial-and-error approaches to targeting.

Solution Overview

The Solution

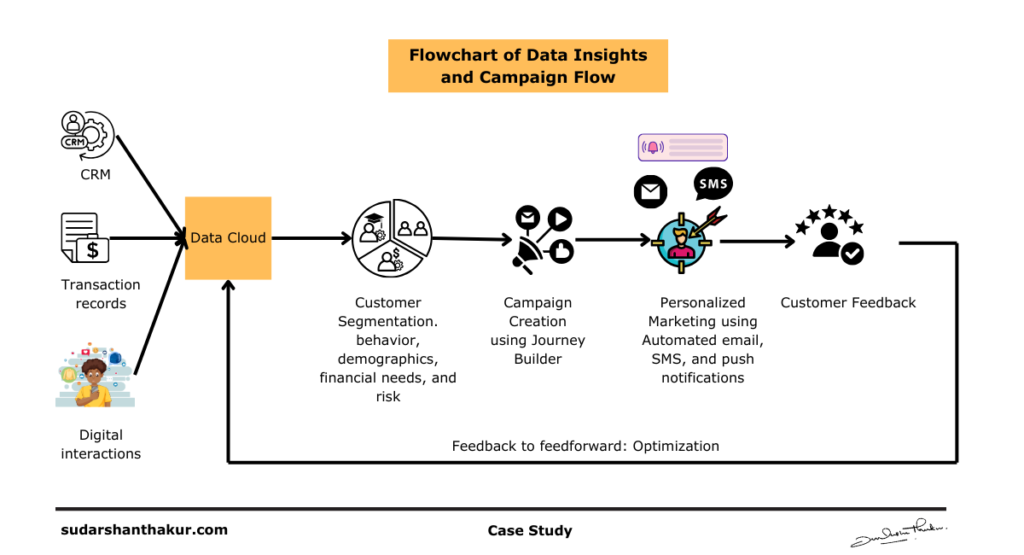

Implementation of Salesforce Data Cloud:

- Consolidated all data sources, including CRM, transactional records, and digital interaction logs, into a centralized system.

- Created Customer 360 Profiles, providing a unified view of each customer.

2. Real-Time Insights and Predictive Analytics:

- Leveraged Data Cloud’s capabilities to segment customers based on behavior, demographics, and financial needs.

- Developed predictive models to forecast churn risks and identify cross-sell opportunities.

3. Integration with Salesforce Marketing Cloud:

- Automated personalized customer journeys using Journey Builder in SFMC.

- Delivered customized financial recommendations via email, SMS, and push notifications.

4. Continuous Feedback Loop:

- Collected customer feedback post-interaction and incorporated insights to refine campaigns and products.

Data Model

Building the Foundation

Data Sources:

- CRM data (customer profiles, support tickets)

- Transaction data (purchase history, financial patterns)

- Digital interactions (website and app behavior)

- Social media and survey feedback

Unified Data Model in Data Cloud:

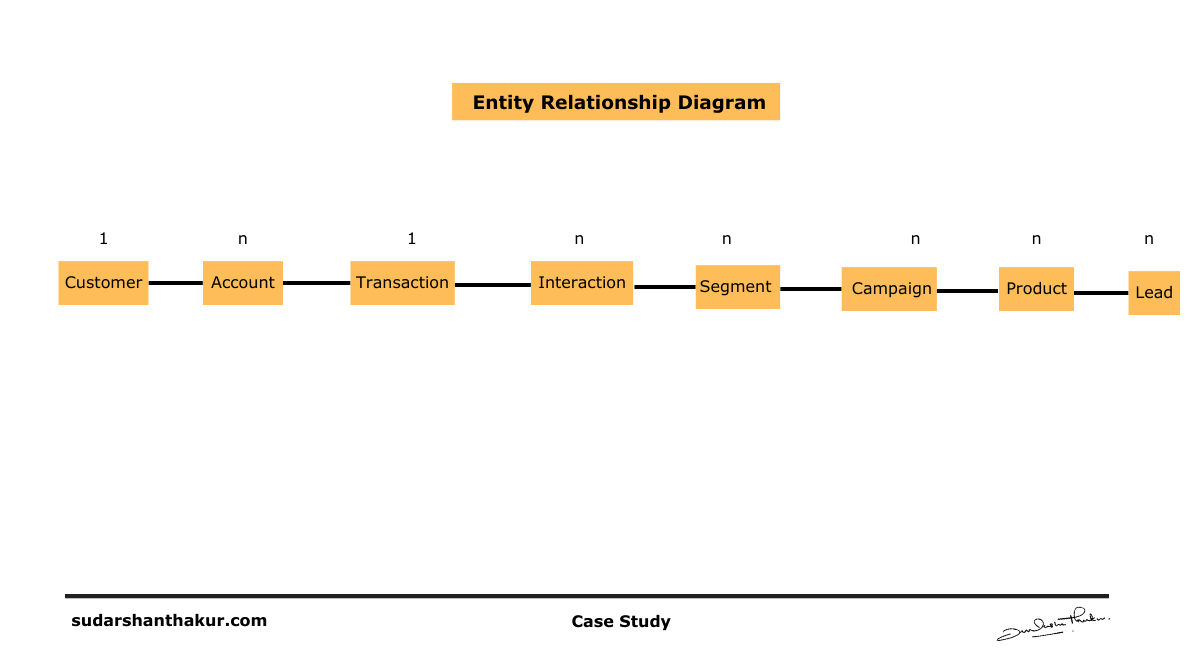

- Entities:

- Customer: Comprehensive profiles with demographics, preferences, and financial goals.

- Transaction: Records of account activity, loan payments, and purchases.

- Campaigns: Information on past and ongoing marketing campaigns.

- Feedback: Customer satisfaction metrics and qualitative insights.

- Relationships:

- One-to-Many: Customer → Transactions

- One-to-Many: Customer → Campaigns

- One-to-One: Customer → Feedback

Business Model

Customer-Centric Approach:

- Transitioned to a customer-first strategy, offering tailored financial products like investment options, credit upgrades, and insurance bundles.

Revenue Streams:

- Boosted revenue by enhancing upselling and cross-selling capabilities.

- Attracted new customers by demonstrating a personalized, data-driven approach.

Operational Efficiency:

- Reduced campaign production time by 30% through automation.

- Optimized budget allocation by focusing on high-value customers.

Marketing Strategy

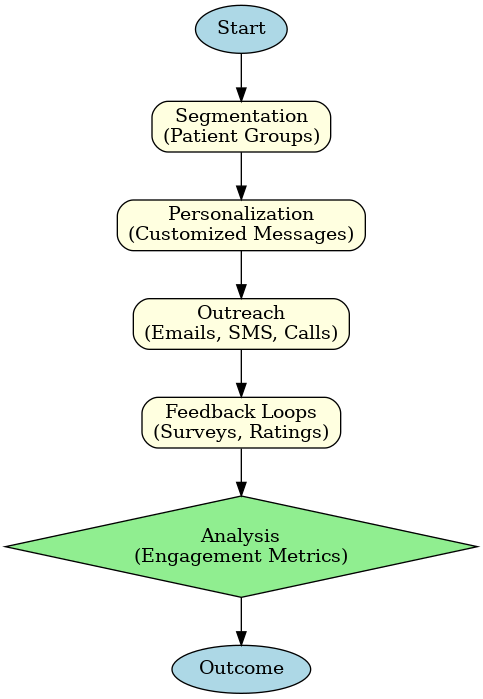

Audience Segmentation and Personalization

Goal: Improve customer targeting through data-driven insights to deliver personalized campaigns.

- Segmentation Strategy:

- Use behavioral data (transaction history, interaction history) and demographic data (age, location, financial goals) to segment customers.

- Create specific segments such as High Net-Worth Individuals (HNWI), Mortgage Seekers, Investors, and Low-Risk Customers based on their past interactions and behaviors.

- Leverage predictive analytics powered by Salesforce Data Cloud to forecast future financial needs and behaviors of customers.

- Personalization:

- Emails: Automate personalized email campaigns with tailored messages, product recommendations, and offers relevant to the segmented customer base.

- SMS and Push Notifications: Use personalized messaging to alert customers about important financial events, account activities, or promotional offers that are relevant to their financial situation.

2. Multi-Channel Marketing Campaigns

Goal: Build a comprehensive marketing ecosystem by integrating Salesforce Marketing Cloud with other marketing tools and touchpoints.

- Omnichannel Campaigns:

- Email Marketing: Design automated email journeys that lead the customer from awareness to consideration and conversion, with personalized content at every step.

- SMS Marketing: Send time-sensitive offers (e.g., low-interest loans, early bird investment opportunities) to high-value customers based on their interaction history.

- Website and Landing Pages: Optimize customer journeys on your website by using personalized banners, offers, and content based on customer segmentation and behavior.

- Social Media Ads: Run targeted ads (e.g., LinkedIn, Facebook) based on insights derived from Salesforce Data Cloud, ensuring the right offers are shown to the right audience.

3. Data-Driven Campaign Optimization

Goal: Continuously improve the performance of marketing campaigns using real-time data and analytics.

- Analytics Strategy:

- Performance Tracking: Use Salesforce Data Cloud’s analytics tools to track the performance of every marketing touchpoint, from email opens to conversions.

- A/B Testing: Implement A/B testing in email campaigns, landing pages, and SMS campaigns to determine the most effective messaging, design, and call-to-action for each customer segment.

- Real-Time Insights: Adjust marketing strategies in real-time based on KPIs like engagement rates, conversion rates, and campaign ROI.

- Campaign Adaptation:

- Based on the real-time performance insights, make adjustments to the marketing campaigns such as altering the timing of email sends, tweaking the content, and adjusting offers to optimize conversion.

4. Customer Retention and Feedback Loop

Goal: Increase customer retention and long-term loyalty by continuously engaging with customers and incorporating feedback.

- Loyalty Programs:

- Rewards and Offers: Implement customer loyalty programs offering benefits for continued usage of services such as discounted rates, referral bonuses, and exclusive investment opportunities.

- Cross-sell/Up-sell: Use Salesforce Data Cloud insights to identify opportunities for cross-selling and up-selling relevant financial products (e.g., insurance, investment accounts) based on the customer’s profile and activity.

- Feedback and Surveys:

- After every major interaction or product usage, send customers personalized surveys to collect feedback on their experience and suggestions for improvement.

- Use this data to fine-tune future campaigns and enhance customer service strategies.

5. Marketing Technology Integration

Goal: Ensure that all marketing tools and platforms are integrated into a seamless, automated workflow.

- Salesforce Marketing Cloud Integration:

- Integrate Salesforce Marketing Cloud with Salesforce Data Cloud to ensure data flows seamlessly between the two platforms, enabling better segmentation, personalization, and automation.

- Implement Journey Builder to create automated customer journeys based on their stage in the decision-making process (e.g., leads, prospects, active customers).

- Third-Party Tools Integration:

- Use tools like Google Analytics, SEMrush, and Facebook Insights to further enrich data and improve targeting accuracy.

- Automate customer interactions with chatbots, social media monitoring, and retargeting ads.

6. Budget and ROI Calculation

Goal: Efficiently allocate resources and ensure positive returns on marketing investments.

- Budget Allocation Strategy:

- Prioritize budget towards high-performing channels (e.g., email marketing, SMS, and paid social ads) while testing new channels to expand reach.

- Set up automated tracking for every dollar spent to measure ROI per campaign.

- Expected ROI:

- Calculate ROI by measuring revenue generated through cross-sell and up-sell campaigns, new customer acquisition, and customer lifetime value (CLTV).

- Track Customer Acquisition Cost (CAC) and compare it to the revenue per customer to ensure profitability.

Key KPIs to Measure Marketing Effectiveness

- Customer Engagement Rate: Track the rate at which customers open emails, click on links, and interact with SMS messages.

- Campaign ROI: Measure how much revenue was generated from each marketing dollar spent.

- Churn Rate Reduction: Track the decline in the percentage of customers opting out or leaving the service.

- Customer Lifetime Value (CLTV): Monitor the long-term financial impact of retaining customers through tailored campaigns.

- Cross-Sell and Up-Sell Success: Measure the percentage of customers who purchased additional products as a result of targeted marketing.

Results

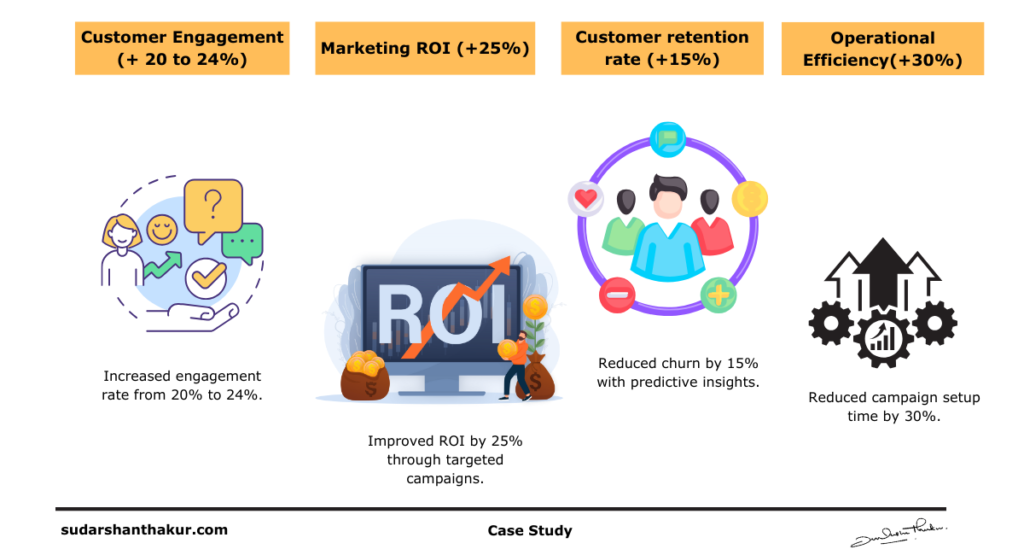

Customer Engagement:

- Increased engagement rate from 20% to 30%.

Marketing ROI:

- Improved ROI by 25% through targeted campaigns.

Customer Retention:

- Reduced churn by 15% with predictive insights.

Operational Efficiency:

- Reduced campaign setup time by 30%.